The perfect design process doesn’t exist–each project warrants various tools, methodologies, and processes. As a seasoned designer, I have to evaluate business goals to ensure a project’s success and figure out the best solution for a design problem.

Research & Discovery

We first held a workshop to understand the client’s vision and then utilized our financial expertise and startup experience to develop the optimal user journey.

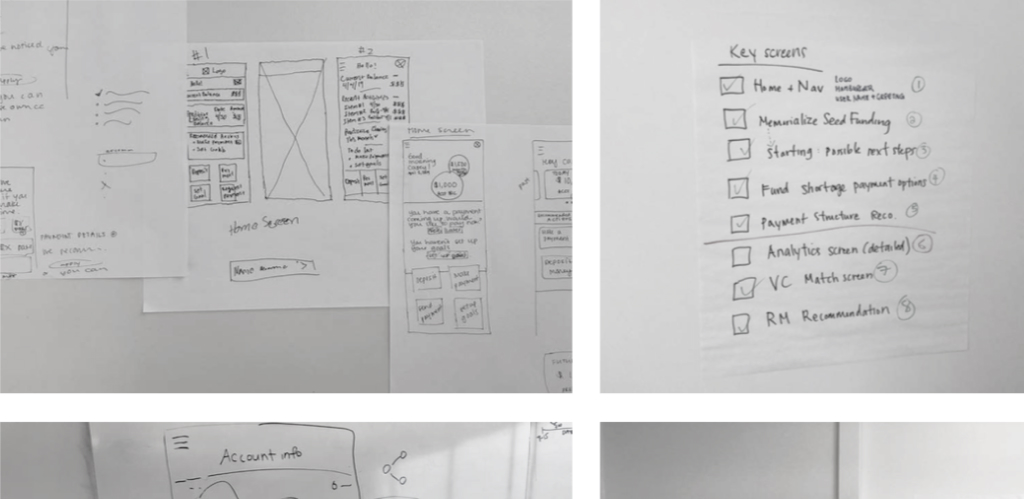

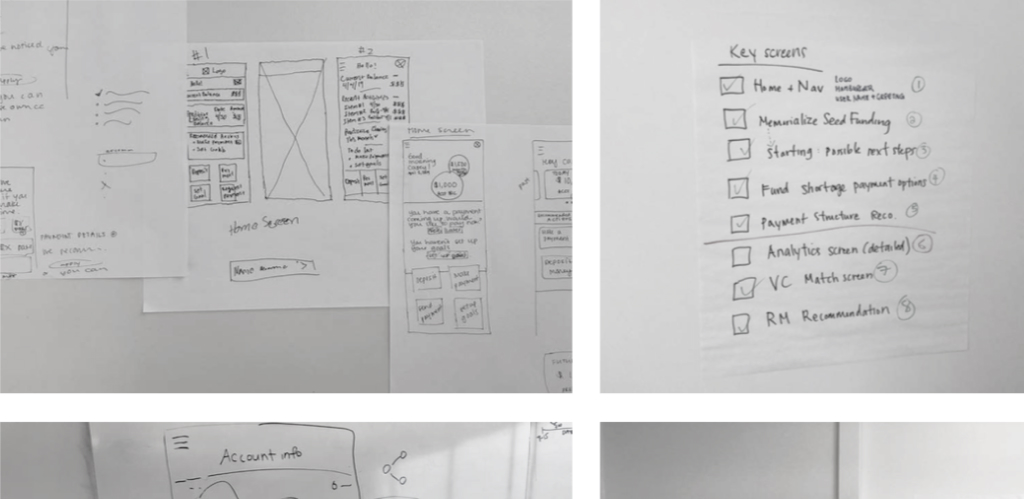

- We sketched our initial ideas out to quickly gather feedback from the stakeholders and SMEs.

- We also spoke to a range of users who have engaged or created their own startups. Our target audience is mostly young and tech savvy, so we wanted to create an experience that drives engagement with rich interactions that create those delightful moments.

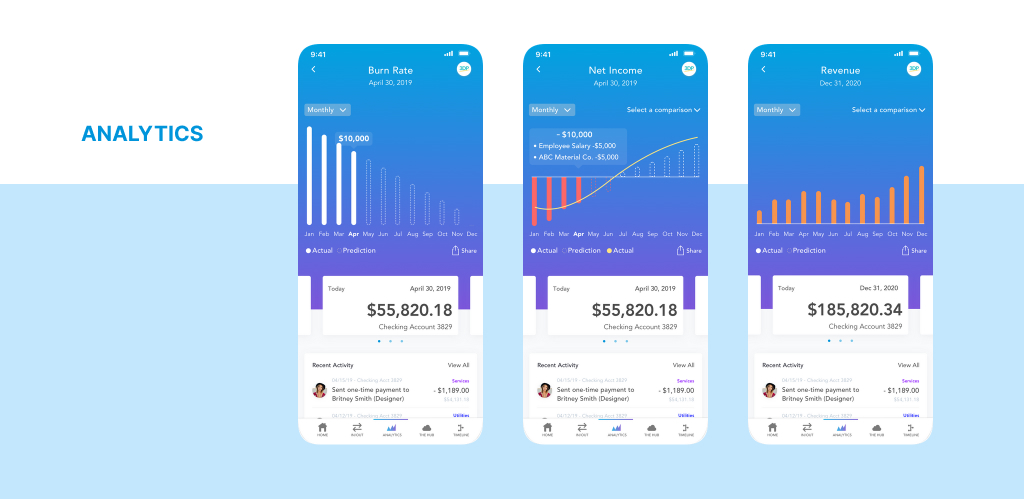

We learned that founders want a simple way to see their financials, upcoming spend, where they have spent their money and their burn rate.

Design & Iterate

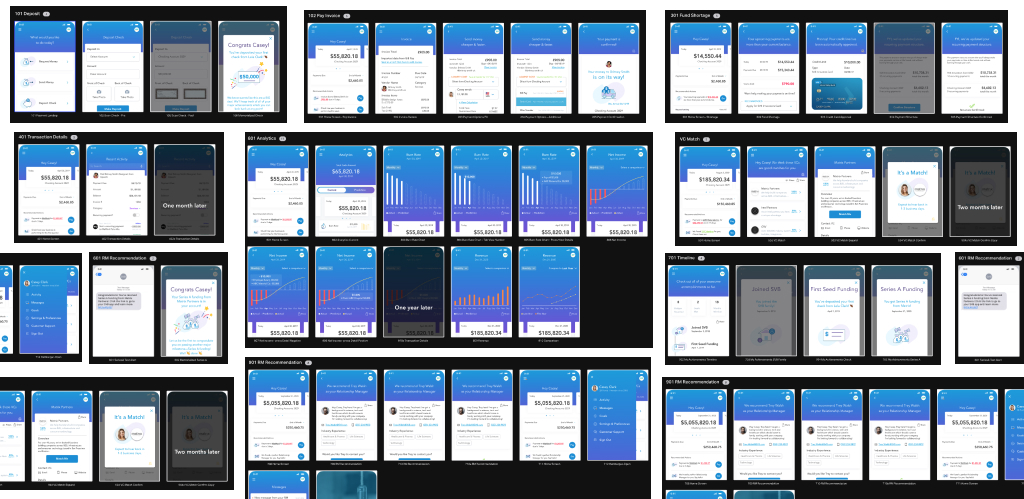

We defined a list of key moments in the founder's journey and did more research and interviews to help define user stories. We defined the value prop of each key moment of the journey from a UX perspective.

We worked with the client every step of the way to validate design direction, wireframes and high-fidelity mockups.

We only had 8 days to develop a full blown prototype, so prioritization of the key moments (25+) was key. Then we started to ideate on a rapid MVP prototype to help bring to life the vision with a storytelling approach.

At this point in order to hit our deadlines, we divide-and-conquered the top key moments and began wireframing and sketching. As the lead designer, I did daily check-ins with the designers and validated the user flows before turning the sketches to mockups.

Key Moments

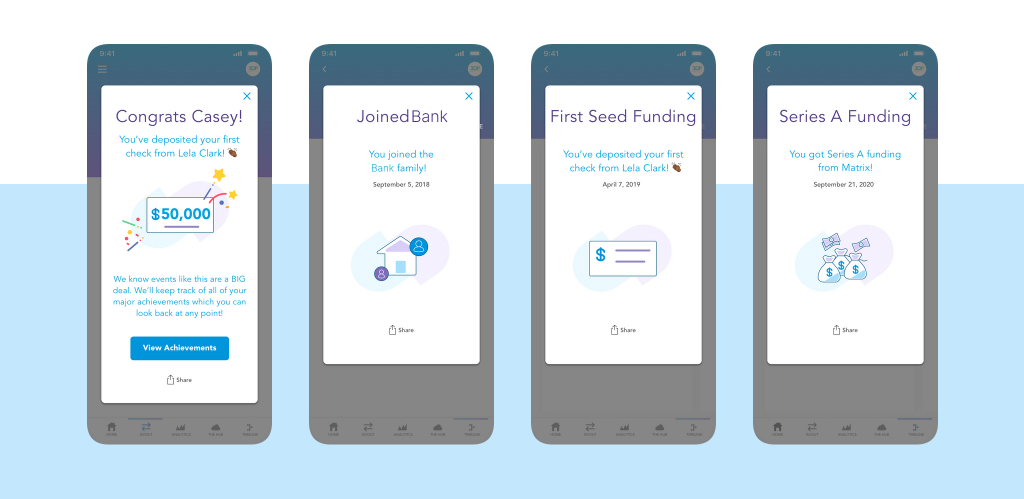

- Milestones: Highlight and acknowledge key moments in the experience to celebrate every startup milestones.

- Payments made simple: There's too many different types of payment methods.

- Smart payment advice: Continuing the advisor role, we want to make sure to guide the customer at the right direction at any time.

- Analytics: Based on research, our users told us that to take it a step further, we need to include visual analytics to help them make better business decisions.

We only had 8 days to develop a full blown prototype, so prioritization of the key moments (25+) was key. Then we started to ideate on a rapid MVP prototype to help bring to life the vision with a storytelling approach.

We only had 8 days to develop a full blown prototype, so prioritization of the key moments (25+) was key. Then we started to ideate on a rapid MVP prototype to help bring to life the vision with a storytelling approach.